Türkiye ranks 12th in OECD Tax Competitiveness Index

Türkiye ranks 12th in OECD Tax Competitiveness Index

Türkiye ranks 12th in OECD Tax Competitiveness Index

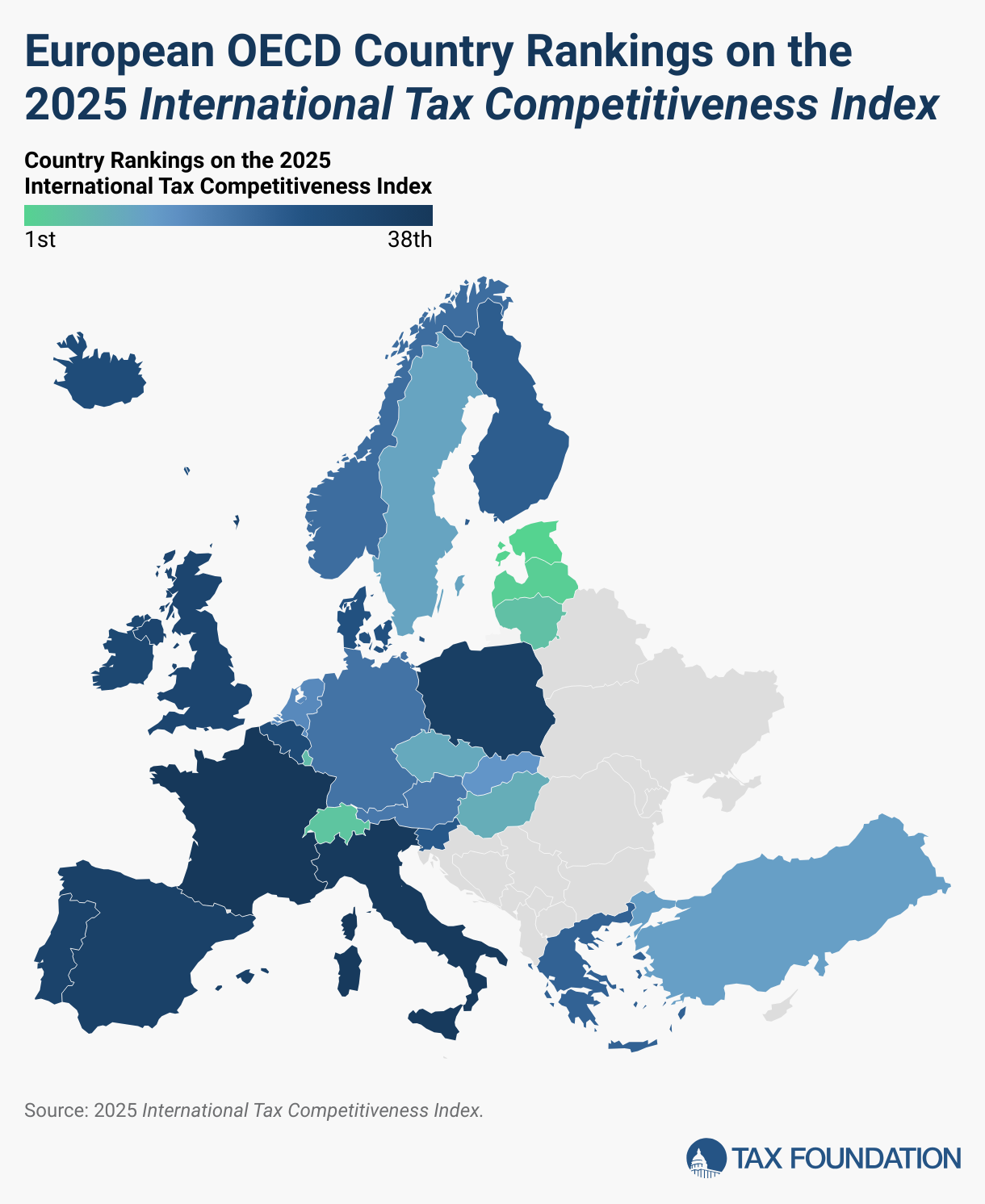

Türkiye ranks 12th out of 38 OECD countries with an overall score of 75.9, confirming its position among the world’s top-tier performers.

- 5th for individual income tax

- 8th for cross-border tax rules

- 17th for consumption taxes

- 21st for corporate income tax

- 24th for property taxes

Türkiye clearly outperforms most Western European countries (France 38th, Italy 37th, Spain 34th, Belgium 30th, United Kingdom 32nd) and is closing in on the continent’s most competitive economies such as Estonia, Switzerland, and Lithuania.

This ranking reflects an attractive and competitive tax system, modern and flexible cross-border rules, and a balanced fiscal structure compared to other OECD economies.

In other words, Türkiye is establishing itself as a competitive tax hub at the heart of the EMEA region, combining a stable environment for foreign businesses with openness to international investment flows.

2025 Rankings

For the 12th year in a row, Estonia has the best tax code in the OECD. Its top score is driven by four positive features of its tax system. First, it has a 22% tax rate on corporate income that is only applied to distributed profits. Second, it has a flat 22% tax on individual income that does not apply to personal dividend income. Third, its property tax applies only to the value of land, rather than to the value of real property or capital. Finally, it has a territorial tax system that exempts 100% of foreign profits earned by domestic corporations from domestic taxation, with few restrictions.

The structure of a country’s tax code is a determining factor of its economic performance. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities. In contrast, poorly structured tax systems can be costly, distort economic decision-making, and harm domestic economies.

Many countries have recognized this and have reformed their tax codes. Over the past few decades, marginal tax rates on corporate and individual income have declined significantly across the Organisation for Economic Co-operation and Development (OECD). Now, most OECD nations raise a significant amount of revenue from broad-based taxes such as payroll taxes and value-added taxes (VAT).[1]

Not all recent changes in tax policy among OECD countries have improved the structure of tax systems; some have made a negative impact. Though some countries, like Austria, have reduced their corporate income tax rates by several percentage points, others, like France, the Slovak Republic, and Slovenia, have increased them. Corporate tax base improvements have occurred in Germany, the United Kingdom, and the United States, while the corporate tax base has been made less competitive in the Czech Republic and Slovenia. Canada and Finland are phasing out temporary improvements to their corporate tax bases that the United Kingdom and the United States have made permanent and expanded.[2]

In recent years, tax policy has increasingly drifted away from its traditional roles of raising government revenue and encouraging investment into the toolbox of international tax and trade disputes, with import tariffs, digital service levies, and extraterritorial taxes deployed to exert economic pressure. In this environment, policymakers should refocus on neutral, internationally competitive tax policies that raise revenue with minimal harm to investment and economic growth. The variety of approaches to taxation among OECD countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the International Tax Competitiveness Index—a relative comparison of OECD countries’ tax systems with respect to competitiveness and neutrality.

The International Tax Competitiveness Index

The International Tax Competitiveness Index (ITCI) seeks to measure the extent to which a country’s tax system adheres to two important aspects of tax policy: competitiveness and neutrality.

A competitive tax code is one that keeps marginal tax rates low. In today’s globalized world, capital is highly mobile. Businesses can choose to invest in any number of countries throughout the world to find the highest rate of return. This means that businesses will look for countries with lower tax rates on investment to maximize their after-tax rate of return. If a country’s tax rate is too high, it will drive investment elsewhere, leading to slower economic growth. In addition, high marginal tax rates can impede domestic investment and lead to tax avoidance.

According to research from the OECD, corporate taxes are most harmful for economic growth, with personal income taxes and consumption taxes being less harmful. Taxes on immovable property have the smallest impact on growth.[3]

Separately, a neutral tax code is simply one that seeks to raise the most revenue with the fewest economic distortions. This means that it doesn’t favor consumption over saving, as happens with investment taxes and wealth taxes. It also means few or no targeted tax breaks for specific activities carried out by businesses or individuals.

As tax laws become more complex, they also become less neutral. If, in theory, the same taxes apply to all businesses and individuals, but the rules are such that large businesses or wealthy individuals can change their behavior to gain a tax advantage, this undermines the neutrality of a tax system.

A tax code that is competitive and neutral promotes sustainable economic growth and investment while raising sufficient revenue for government priorities.

There are many factors unrelated to taxes which affect a country’s economic performance. Nevertheless, taxes play an important role in the health of a country’s economy.

To measure whether a country’s tax system is neutral and competitive, the ITCI looks at more than 40 tax policy variables. These variables measure not only the level of tax rates, but also how taxes are structured. The Index looks at a country’s corporate taxes, individual income taxes, consumption taxes, property taxes, and the treatment of profits earned overseas. The ITCI gives a comprehensive overview of how developed countries’ tax codes compare, explains why certain tax codes stand out as good or bad models for reform, and provides important insight into how to think about tax policy.

Due to some data limitations, recent tax changes in some countries may not be reflected in this year’s version of the International Tax Competitiveness Index.

Source : International Tax Competitiveness Index 2025, Tax Foundation.