The new U.S. tariffs: What impact for Türkiye?

The new U.S. tariffs: What impact for Türkiye?

In August 2025, the United States raised tariffs on a wide range of countries under its “reciprocal tariffs” policy. While major trade partners such as China, India, and Russia are now subject to rates between 25% and 41%, Türkiye was placed at the lower end with a 15% duty, up from 10% earlier in the year.

Combined with the steep 50% surcharge on steel and aluminum, this shift is reshaping Turkish exports to the U.S. market. What does this new framework mean, which industries are most at risk, and where might opportunities still lie for Turkish businesses?

A shifting global trade environment

The Office of the U.S. Trade Representative (USTR) introduced country-specific tariff schedules in early August, covering most customs lines. These new duties come on top of existing regimes—such as Section 232 surcharges on steel, aluminum, and vehicles—underscoring a broader move toward protectionism.

The measures are already under legal challenge. At the end of August, a federal appeals court ruled parts of the surcharges unlawful, but postponed any annulment while a potential Supreme Court review is pending. For now, the tariffs remain fully in effect.

Türkiye’s relative advantage

At 15%, Türkiye’s tariff rate is still lower than many peers facing duties of up to 41%. The Turkish Ministry of Trade has described this as “positive differentiation,” highlighting that it preserves competitive access to the U.S. market for Turkish goods.

In 2024, trade between Türkiye and the U.S. reached USD 32.1 billion, including USD 16.7 billion in Turkish exports. The U.S. remains an important destination, though not a critical dependency, as the EU continues to be Türkiye’s main export market.

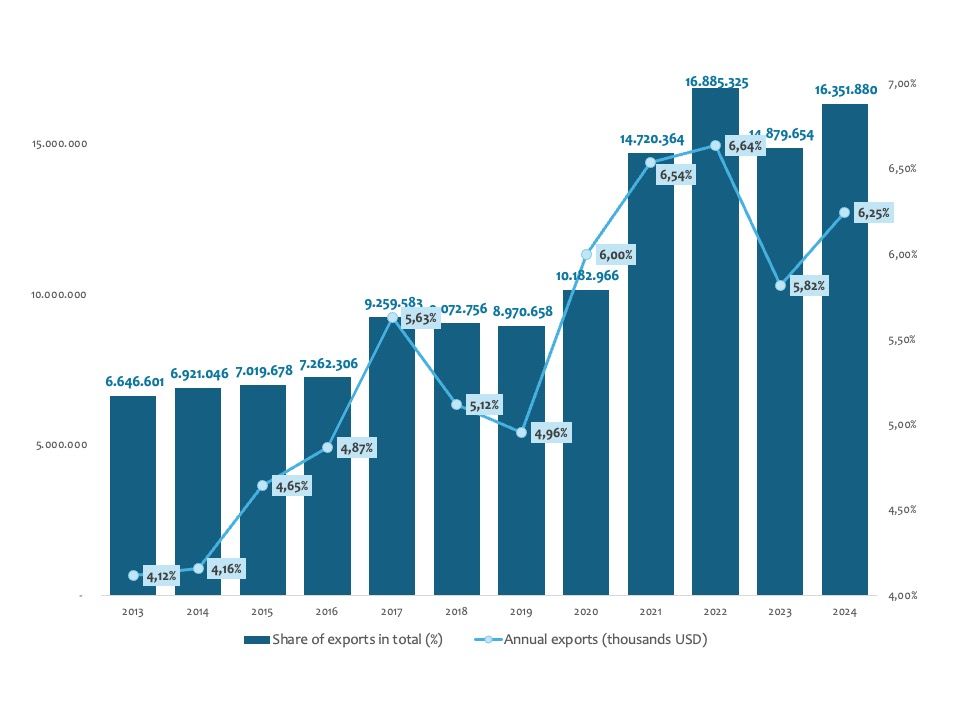

Evolution of Turkish exports to the USA

Source : Turkish National Statistical Institute (TÜIK)

Sectors under pressure

- Metals (steel and aluminum): heavily impacted by a 50% duty, which undermines the competitiveness of Turkish steelmaking. Industry players will need to shift toward higher value-added products and consider assembly or finishing strategies within the U.S. itself.

- Textiles, apparel, and carpets: subject to the 15% increase, these flagship export categories risk margin compression. Brands will need to focus on differentiation, quality, and optimized delivery times.

- Machinery and auto parts: also affected by the 15% duty, but still benefit from a reputation for reliability. Here, strengthening after-sales services and ensuring local availability may offset price effects.

- Agri-food: a mixed picture. Certain opportunities remain, as seen in 2025 with Turkish egg exports boosted by a shortage in the U.S. market.

E-commerce in turmoil

On August 29, 2025, the U.S. eliminated the USD 800 de minimis threshold for imports. From now on, even small parcels require full declaration and are subject to duties.

For Turkish companies operating direct-to-consumer (DTC) models, this means:

- building duties and taxes directly into checkout,

- rethinking pricing and delivery strategies,

- exploring U.S.-based logistics solutions such as warehouses or subsidiaries.

How Turkish exporters can turn this challenge into opportunity

At 15%, Türkiye still enjoys a relative edge compared with many competitors, making it a viable alternative to China in U.S. supply chains. Yet, legal uncertainty around the tariffs means exporters should include adjustment clauses in contracts and prepare for multiple scenarios.

To stay competitive, Turkish firms must adapt pricing strategies, secure resilient logistics—possibly by investing in U.S. operations—and maintain strict compliance to avoid penalties. Strengthening local partnerships and distributor networks, while positioning brands on value rather than cost, will be essential. Diversifying exports toward Europe also remains a key strategy to spread risk.

The solution : adaptation over crisis

Rising U.S. tariffs are a setback for some sectors, particularly steel, but Türkiye retains a relative advantage compared to many peers. For businesses able to adapt—through upgrading products, transparent pricing, and building a stronger U.S. presence—this shift can become not just a hurdle, but a springboard for growth.